how are rsus taxed in the uk

Restricted Stock Units. Employers will usually deal.

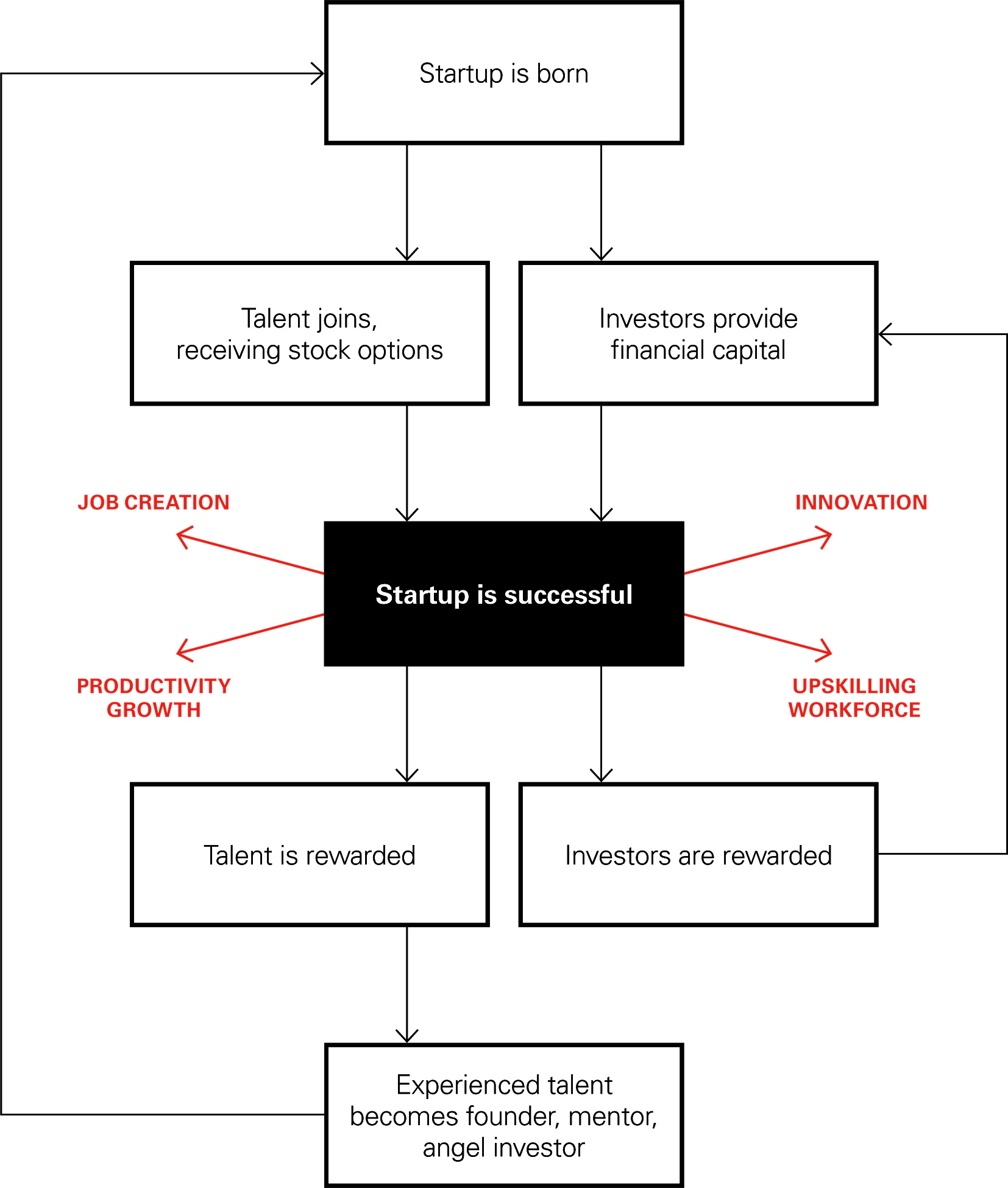

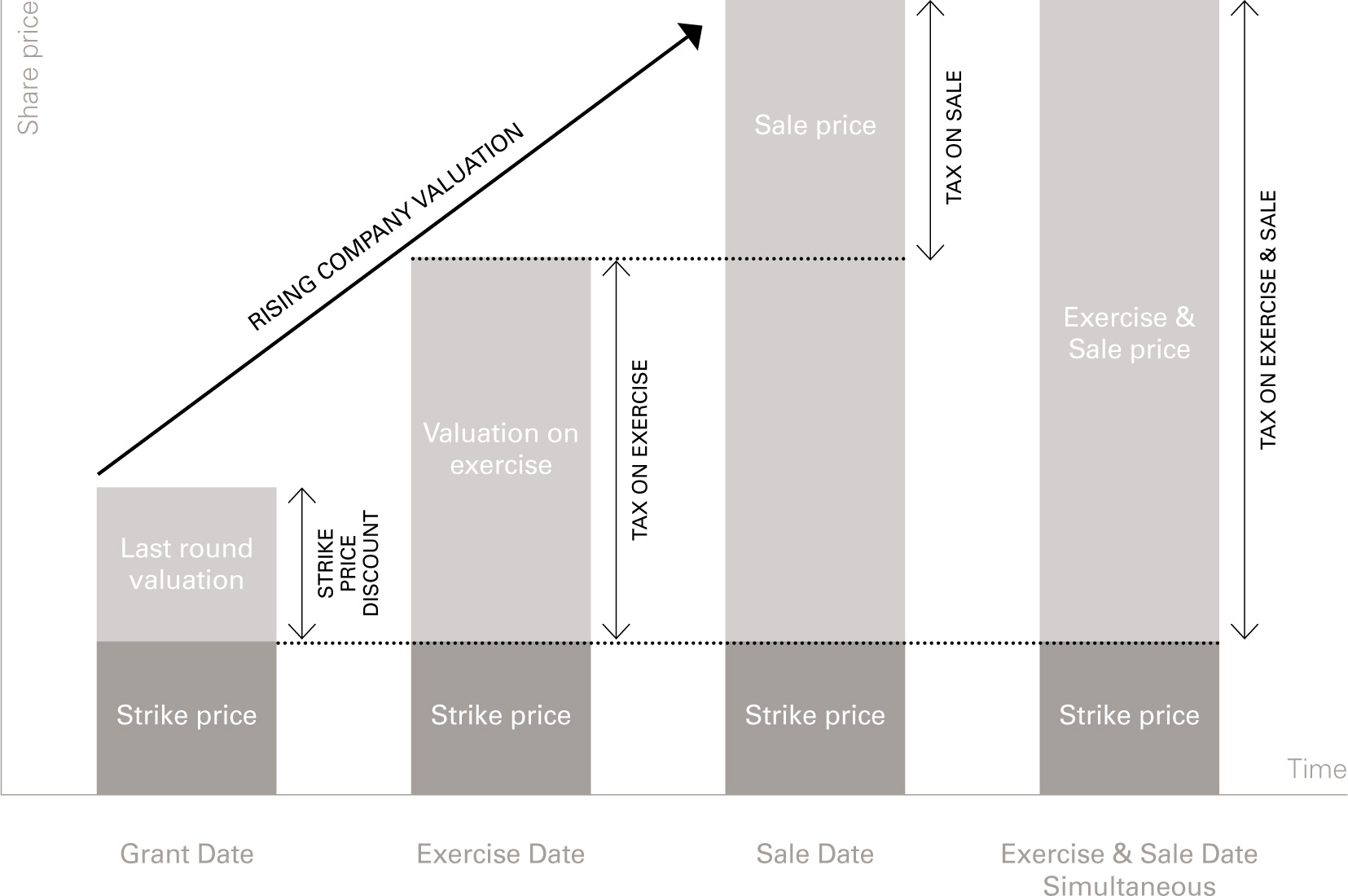

Rewarding Talent Country By Country Review Index Ventures

Restricted Stock Units.

. In most circumstances tax will be paid before you receive the shares ie. US RSUs vested and sufficient shares were sold to cover the 47 tax withholding obligation plus commission and fees. Lets say you are granted 200 RSUs on 3112 14From your OP these will vest become yours in equal instalments over the next four anniversary dates -so 50 shares on.

Now that weve walked through how RSUs get taxed its time to actually calculate your tax bill. Restricted stock and RSUs are taxed upon delivery and subject to progressive income tax up to 56 percent. April 9 2021 Written by Sam Ratnage.

At this point the employee is charged to income tax on. Postpone shareholder dilution until the time of vesting. RSUs are not taxable when they are granted.

If you already earn in excess of this and the RSUs. The first time that they are exposed to tax is upon vesting at which time both income tax and NIC are due. How Are Restricted Stock Units RSUs Taxed.

RSU Tax Calculator. Restricted stock units are one way an employer can give employees shares of the company. We created a free excel tool to help with that.

The UK tax treatment for RSUs is similar to how your salary is taxed. The UK tax treatment for RSUs is similar to how your salary is taxed. The UK tax treatment for RSUs is similar to how your salary is taxed.

When your restricted stock units vest and you actually take ownership of the shares two dates that almost always. Taxes at RSU Vesting When You Take Ownership of Stock Grants. Get consistent tax treatment and timing.

Companies use units instead of the actual restricted stock or shares because they can. The taxable amount will be the fair market value of the shares. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest.

The gain from the sale of shares is subject to tax as capital income at 30 percent up to EUR30000 and. The UK tax treatment for RSUs is similar to how your salary is taxed. Otherwise they will need to be.

An RSUs grant does not typically constitute taxable incomeA RSUs vest first in cash then it is taxed as. RSU income would be taxable in the UK if you are UK tax resident these would be subject to income tax and NIC if paid through a UK payroll. Unlike traditional stock options RSUs are always worth.

The proceeds from this sale were used to pay the UK tax. You will also pay employers. You will pay income tax and national insurance on the value of RSUs vested.

The restricted market value was 80 and the employee paid 50. Recently we have seen an uptick in enquiries about the pros and cons. Tideways Guide for Tech Employees.

An RSU is granted with restriction of not being able to sell for 1 Year. This is different from incentive stock. If the RSUs take you over 100000 you will pay income tax at a marginal rate of 60 plus the employers National Insurance.

You will receive the net.

7 Ways To Start Minimizing Next Year S Taxes Now

How Do Microsoft Restricted Stock Units Rsus Work Avier Wealth Advisors

What Does An Ipo Mean For Employees Global Shares

How Are Employee Stock Options Taxed The Motley Fool

Rewarding Talent Country By Country Review Index Ventures

Avoid Capital Gains Tax In Ireland Bed Breakfast Sales Explained Youtube

7 Ways To Start Minimizing Next Year S Taxes Now

Negotiating Salaries At Startups Like Databricks Chime Brex And More

Tax Efficiency Around Rsus The Lemon Fool

How Do Microsoft Restricted Stock Units Rsus Work Avier Wealth Advisors

Long Term Incentive Rewards Uk Reporting For Internationally Mobile Employees Blick Rothenberg

Avoid Capital Gains Tax In Ireland Bed Breakfast Sales Explained Youtube